The cannabis industry in the US and Canada is booming.

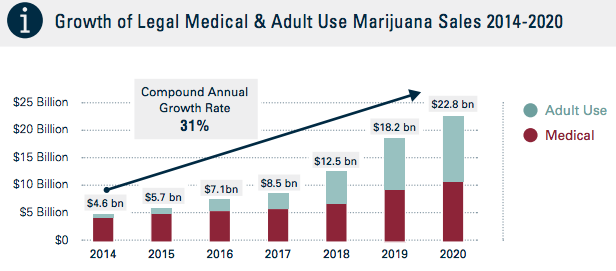

Last year, legal marijuana sales across North America totalled $7.1 billion as the industry grew by an unprecedented 30 per cent year-on-year, according to a report by .

And sales across the States and Canada are forecasted to top a staggering $22 billion by 2021, assuming a compound annual growth rate of at least 25 per cent.

(Source: Arcview)

While recreational and medical cannabis use is legal in just eight US states, Canada has fully legalized the plant for medical purposes across the country and is now edging towards recreational legalization, which is expected to take effect on or before July 1, 2018 and will make it the first G7 country to do so.

.png)

This means that in less than a year, adult Canadian citizens will be able to order cannabis products online from certified sellers and have them delivered to their doors via Canada Post.

Couple this prospect with sky-high growth projections exceeding 200 per cent over a four-year period, and a savvy investor might see a cash cow waiting to be milked.

So why are so many still afraid that investments in the sector will go up in smoke?

Family Wealth Report recently spoke to Aaron Salz, a former cannabis analyst and founder and chief executive of cannabis companies are now financing smaller ones in exchange for revenues down the road; they're buying real estate; they're buying technology operations. Things are moving very quickly.”

He warned, though, that investors must take caution and ensure they “carry out proper due diligence on cannabis companies as there are still some bad actors operating”.